This 2025 update distils the latest official UK research (DSIT/Home Office Cyber Security Breaches Survey 2025), the Verizon 2025 DBIR, and IBM’s 2025 Cost of a Data Breach into one practical briefing for decision‑makers. Where useful, we highlight UK sector examples (e.g., Synnovis, British Library) and the policy direction for the year ahead (Cyber Governance Code of Practice; Cyber Security & Resilience Bill; ransomware proposals).

Bonus Material: Download Cybersecurity Statistics UK 2025: UK Trends, Facts & Board Actions

Key Findings

- Prevalence down overall to 43% of UK businesses identifying a cyber breach/attack in the last 12 months, but risk concentrates in larger firms (74% of large; 67% of medium). Phishing remains the most disruptive.

- Costs are real even when “small”: the average total cost of the most disruptive breach was £1,600 (all businesses) and £3,240 (charities). Among those with a non‑zero cost, the mean rises to £8,260 (businesses).

- Controls adoption gap persists: only 40% of businesses use any 2‑factor authentication (2FA) (92% of large), with similarly low adoption for VPN (31%) and user monitoring (30%).

- Third‑party risk jumped: DBIR 2025 finds third‑party involvement doubled to ~30% of breaches; ransomware present in 44% of breaches (median payment $115k; 64% did not pay).

- Policy direction: UK launched a Cyber Governance Code of Practice (Apr 2025), published a policy statement for a Cyber Security & Resilience Bill (Apr 2025), and issued its ransomware proposals response (Jul 2025) signalling restrictions on public‑sector/CNI ransom payments and broader incident/payment reporting.

- What to do now (90 days): baseline to Cyber Essentials (v3.2), adopt NCSC 10 Steps, uplift MFA, patching, backups/IR runbooks, and supplier risk reviews, then prove it with evidence.

Need help operationalising?

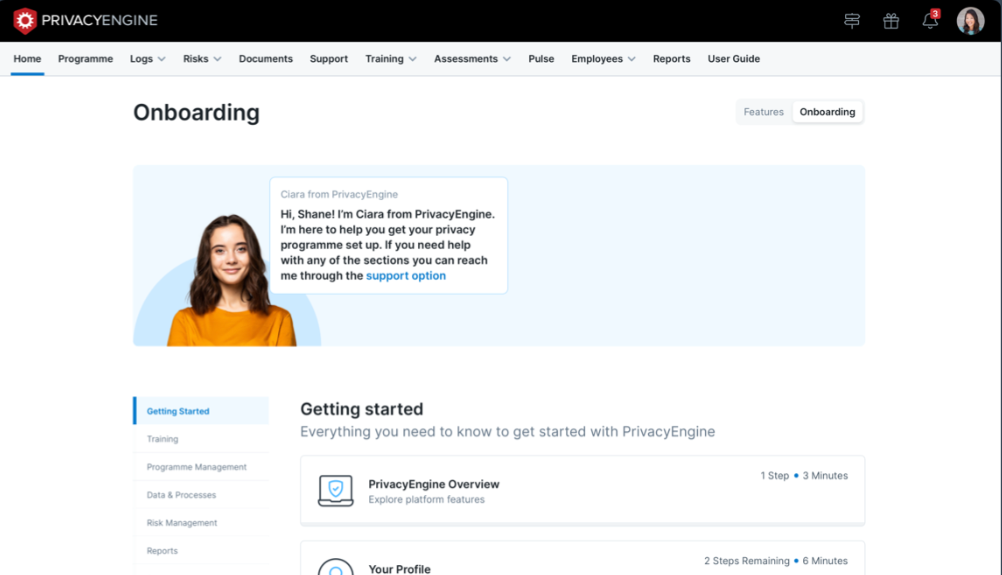

• Book a demo to see PrivacyEngine in action

• Free trial: stand up Records of Processing, DPIA, Third‑Party Assessments, Incident Playbooks in hours: Get Started

2024 vs 2025 at a glance (UK & global context)

| Metric | 2024 | 2025 | Notes |

|---|---|---|---|

| UK businesses identifying a breach/attack | 50% | 43% | DSIT CSBS, all businesses. |

| Weekly or more (among those hit) | 32% | 29% | Share experiencing weekly+ incidents. |

| “Most disruptive” attack = Phishing (businesses) | 61% | 65% | Among orgs that had a breach/attack. |

| Avg total cost of most disruptive breach (all businesses) | £1,205 | £1,600 | DSIT Table 4.5; includes £0 costs. |

| Mean cost among non‑zero cases (businesses) | £6,940 | £8,260 | DSIT Table 4.5 (outcome cases). |

| Any 2FA in use (businesses) | 39% | 40% | DSIT technical controls. |

| VPN for remote staff | 32% | 31% | DSIT technical controls. |

| User monitoring | 30% | 30% | DSIT technical controls. |

| Ransomware share of breaches (DBIR, global) | 32% | 44% | Verizon DBIR; same definition year‑over‑year. |

| Third‑party involvement in breaches (DBIR, global) | 15% | 30% | Verizon DBIR. |

Index

- Prevalence & Frequency (UK 2025)

- Most Disruptive Attack Types

- Financial Impact

- Controls Adoption (Where UK firms lag)

- Supply Chain & Third‑Party Risk

- Ransomware Reality Check

- Sector Snapshots: Education & Health

- UK Policy & Regulation in 2025

- What “Good” Looks Like (NCSC & Cyber Essentials)

- 90‑Day Action Plan + Toolkit

- Sources

Prevalence & Frequency (UK 2025)

Identification of breaches/attacks in the last 12 months:

Overall businesses

By Size

By Sector

By Frequency

Make it measurable with PrivacyEngine: centralise incident logs, near‑misses and corrective actions in Data Breach Management, and tag by pattern for executive reporting.

Most Disruptive Attack Types

- Phishing remains the most disruptive (~65% of businesses name it as the top disruptor).

- Large organisations are more likely to see impersonation (72%), malware (36%), DDoS (15%), and ransomware (14%) compared with all‑business averages.

Board takeaway: invest in people‑centric controls (phishing resilience, impersonation detection, request‑to‑pay verification) and technical health (hardening, EDR, email auth; DMARC/SPF/DKIM).

Financial Impact

- Average total cost of the most disruptive breach in the last year: £1,600 (all businesses), £3,240 (charities).

- Among those with non‑zero costs: mean £8,260 (businesses), £21,540 (charities).

- Staff time is a material component (median £100 among outcome cases; mean £2,050).

Practical step: evidence your cost drivers and recovery SLAs inside Business Continuity, link to Incident Plans, and record lessons learned via DPIA follow‑ups.

Controls Adoption (Where UK firms lag)

Core controls are common (malware protection, firewalls, backups), but advanced measures continue to lag:

- 2‑factor authentication (any): 40% of businesses (92% of large).

- VPN for remote staff: 31%.

- User monitoring: 30%.

- Cyber insurance (any): 45% businesses (specific cyber policy 7%).

- Formal policy & BCP covering cyber: 36% and 32% respectively (all businesses), rising to 87%/79% for large firms.

Close the gap fast with out‑of‑the‑box tasking and evidence capture in Third‑Party Assessments, Risk Management, and Training.

Supply Chain & Third‑Party Risk

Formal Supplier Risk Reviews

Reality check from DBIR 2025: third‑party involvement doubled to ~30% of breaches, with vulnerability exploitation as an initial access vector up 34% YoY to 20%. Only ~54% of perimeter‑device vulns were fully remediated; median 32 days to remediate.

Move beyond “questionnaires only.” Use structured Third‑Party Assessment workflows, request evidence, track findings, and enforce contractual controls.

Ransomware Reality Check

- Present in 44% of breaches (DBIR 2025), up from 32% last year.

- Median payment now $115k, with 64% of victims not paying.

- UK case study: Synnovis (NHS pathology partner) estimated a £32.7m financial hit in FY2024 following the June 2024 attack.

- British Library (Rhysida) recovery estimated at £6–7m; wide operational disruption into 2024/25.

- Act as if breached: practice isolation, restore, and crisis comms. Map your steps in Incident Playbooks and test quarterly.

Download Cybersecurity Statistics UK 2025

Sector Snapshots: Education & Health

- Education (England): high disruption from phishing and ransomware; significant operational impact when recovery requires full‑term rebuilds in a minority of cases.

- Health: system‑wide dependency risk: supplier‑side ransomware (e.g., Synnovis) cascaded across trusts, reinforce supplier segmentation, offline backup testing, and clinical safety impact assessment.

For regulated sectors, align to NHS DSPT, DfE requirements, ISO 27001/27701 and map into PrivacyEngine risk registers.

UK Policy & Regulation in 2025

- Cyber Governance Code of Practice (launched 8 Apr 2025): sets board‑level expectations and links to NCSC Board Toolkit and training.

- Cyber Security & Resilience Bill – Policy Statement (Apr 2025): signals expanded scope for essential digital services, stronger regulator powers, enhanced reporting.

- Ransomware consultation – Government response (22 Jul 2025):

- intent to ban ransom payments for public sector and operators of critical national infrastructure (CNI);

- mandatory incident/payment reporting;

- transparency obligations for private‑sector payers under development.

What this means for boards: treat cyber as a governance obligation; expect tighter reporting and sanctions exposure for unlawful payments; document decision‑making.

What “Good” Looks Like (NCSC & Cyber Essentials)

- Adopt the NCSC 10 Steps (risk management; architecture/config; vuln mgmt; supply chain; incident mgmt; data security; user awareness; monitoring; identity & access; backups).

- Baseline to Cyber Essentials (Requirements v3.2, April 2025) tightens definitions and reinforces MFA/passwordless options; keep high/critical vulnerability fixes within 14 days; remove end‑of‑life software.

Map 10 Steps and Cyber Essentials to your control catalogue in PrivacyEngine; collect evidence and generate audit‑ready reports.

90‑Day Action Plan + Toolkit

First 0–30 Days

- Board mandate: assign cyber owner; adopt Code of Practice; schedule quarterly metrics.

- Baseline: run Cyber Essentials gap; enable MFA for all admins & remote access; disable legacy auth; roll out phishing-resistant factors where feasible.

- Backups: 3‑2‑1 policy; test restores; document RTO/RPO.

Next 31–60 Days

- Patch & protect edge: 14‑day SLA for high/critical; focus on perimeter devices/VPNs; verify with scans.

- Supplier risk: identify tier‑1 criticals; perform evidence‑backed assessment; require incident reporting and MFA.

- IR ready: publish playbooks (phishing, ransomware, vendor outage); define notify thresholds; rehearse.

Final 61–90 Days

- User & exec drills: impersonation/banking change tests; update finance “raise‑to‑verify”.

- Monitoring: enable log retention, alerting on admin anomalies; deploy EDR where gaps exist.

- Assure: run a table‑top, log actions and owners, produce a board pack.

Helpful PrivacyEngine modules

- Record of Processing Activities: map systems & data flows.

- Third‑Party Assessment: supplier questionnaires + evidence + risk actions.

- Risk Management: register, heatmaps, treatment plans.

- Data Breach Management: incident workflow, tasks, notifications, lessons‑learned.

- Data Privacy and Cybersecurity Training: measurable human‑risk reduction.

Talk to us: Schedule a demo or Get Started.

Sources: DSIT, Verizon, IBM, Home Office, IASME/NCSC, Synnovis, British Library © 2025 PrivacyEngine. This briefing is informational only and does not constitute legal advice.